Investeer in de kansrijke vastgoedmarkt van Dubai

Na de succesvolle plaatsing van Dubaifonds 1 zijn wij verheugd Dubaifonds 2 te presenteren.

- Verwacht rendement tussen de 9,8% en 16% p.j.

- Vastgoed volledig in eigendom

- Verwachte looptijd 3 jaar

- Goede lokale en strategische partners

- Gespreide vastgoedportefeuille

- Investeren mogelijk vanaf € 100.000

- Wij investeren altijd met u mee

Ontvang de brochure

Nadat u onderstaand formulier heeft ingevuld, ontvangt u van ons vrijblijvend de brochure.

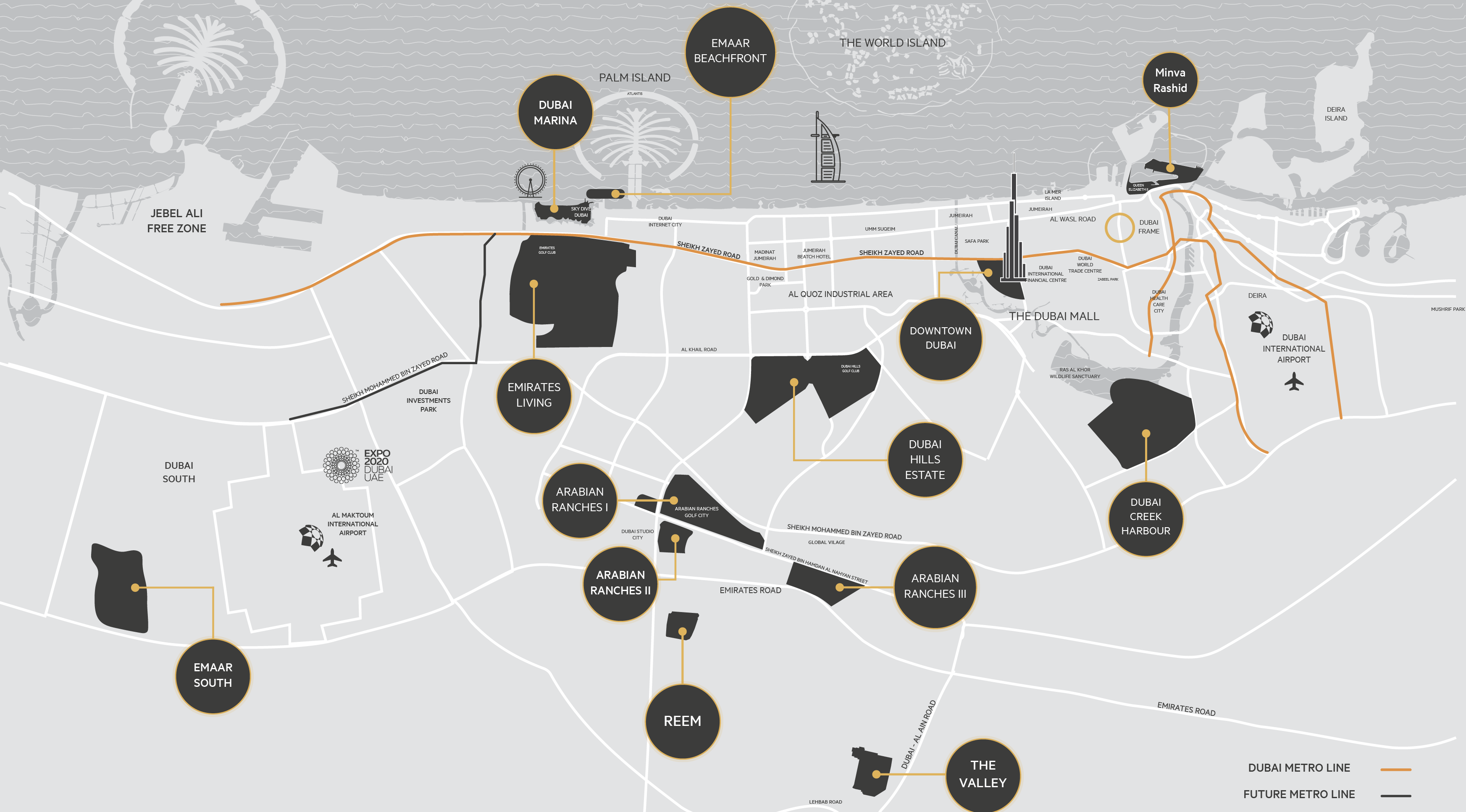

Transformeren van villa's en appartementen

Dubaifonds 2 richt zich op het investeren in te transformeren villa’s en appartementen op A-locaties. Deze bestaande villa’s en appartementen zijn vaak gebouwd in Arabische stijl, terwijl de vraag naar juist de moderne westerse stijl steeds groter wordt. Met ons fonds kopen wij deze villa’s en appartementen in Arabische stijl en we transformeren deze naar westerse standaarden, om deze vervolgens met winst door te verkopen. Door met onze lokale partners scherp in te kopen en kostenbewust te transformeren, behalen wij de meest optimale resultaten.

Opt for our local network

Met het Dubaifonds heeft u profijt van onze in vele jaren opgebouwde kennis en ervaring met vastgoed in Dubai. Wij beschikken op locatie over een groot netwerk van vastgoedspecialisten en adviseurs. Zij staan in nauw contact met ons Nederlandse team én kennen de lokale markt bijzonder goed. Daardoor weten zij niet alleen het juiste vastgoed te selecteren, maar ook het proces soepel en snel te laten verlopen.

5 redenen om te investeren in Dubai

Dubai heeft in de afgelopen decennia een aanzienlijke economische groei doorgemaakt. De stad heeft zich ontwikkeld tot een belangrijk zakelijk en financieel centrum, waardoor het aantrekkelijk is geworden voor internationale investeerders en bedrijven. Het economische succes van Dubai is grotendeels te danken aan proactief overheidsbeleid, zakelijke vriendelijkheid en een kosmopolitische benadering van handel en investeringen.

Dubai is op dit moment één van de meest gewilde plekken om vastgoed aan te kopen in de wereld. Dit komt mede door de indrukwekkende architectuur, het prettige klimaat en de interessante (lagere) vierkante meterprijs van het vastgoed in Dubai. De vastgoedprijzen in Dubai liggen momenteel gecorrigeerd voor inflatie ongeveer 25% onder de piek van 2014.

Dubai heeft in de eerste helft van 2023 indrukwekkende prestaties geleverd in de internationale toerismesector. Met 8,55 miljoen internationale bezoekers heeft Dubai het niveau van 8,36 miljoen toeristen uit 2019 overtroffen, en dat ondanks de pandemische uitdagingen. Deze recordbrekende prestatie brengt Dubai aanzienlijk dichter bij het bereiken van de ambitieuze doelstelling van de Dubai Economic Agenda 2033: Dubai laten horen tot de top drie meest bezochte steden van de wereld.

Dubai heeft zich ingespannen om een bedrijfsvriendelijke omgeving te creëren om investeringen en zakelijke activiteiten aan te trekken. Dit is een van de belangrijkste redenen waarom Dubai in de afgelopen jaren zo snel is gegroeid. Zowel de regelgeving als de gunstige arbeidsvoorschriften bieden een geschikte omgeving voor ondernemingen en investeringen. De belastingen zijn zeer aantrekkelijk, de toegang tot kapitaal is vrij gemakkelijk en de regelgeving is vrij soepel. Het is gemakkelijk om een bedrijf op te richten en zaken te doen.

Jaarlijks publiceert het toonaangevende UBS de wereldwijde vastgoedbubbel-index. In deze index, gepubliceerd op 20 september 2023, staat welke steden de vastgoedprijzen het meest zijn gedaald, waar (verdere) correcties op handen zijn en waar prijsstijgingen zich voortzetten of in de toekomst kunnen plaatsvinden. De vastgoedprijzen in Dubai worden wereldwijd door UBS beoordeeld als fair valued. Met positie 23 van de 25 steden wordt Dubai door UBS gezien als een van de beste steden om momenteel te investeren.

Dubai is waiting for you.

Click one of these buttons to take action.

Wij investeren mee

Omdat wij geloven in wat wij doen, investeren wij als Jupiter Capital Management altijd ten minste voor 5% met u mee. Hiermee hebben wij dezelfde belangen in het fonds als onze investeerders.

Returns

The expected total return could be as high as 16% per year. This return results from the fund's profits. If the fund makes less profit, the return will also be lower. There are risks involved in investing. You may lose part of your investment. You can read more about the risks in the information memorandum.

Participation

Entry into the fund is made by purchasing units at the prevailing net asset value. The amount to be invested should be at least €100,000.

Distribution policy

Rendementsuitkeringen vinden achteraf plaats naar evenredigheid van de gehouden participaties.

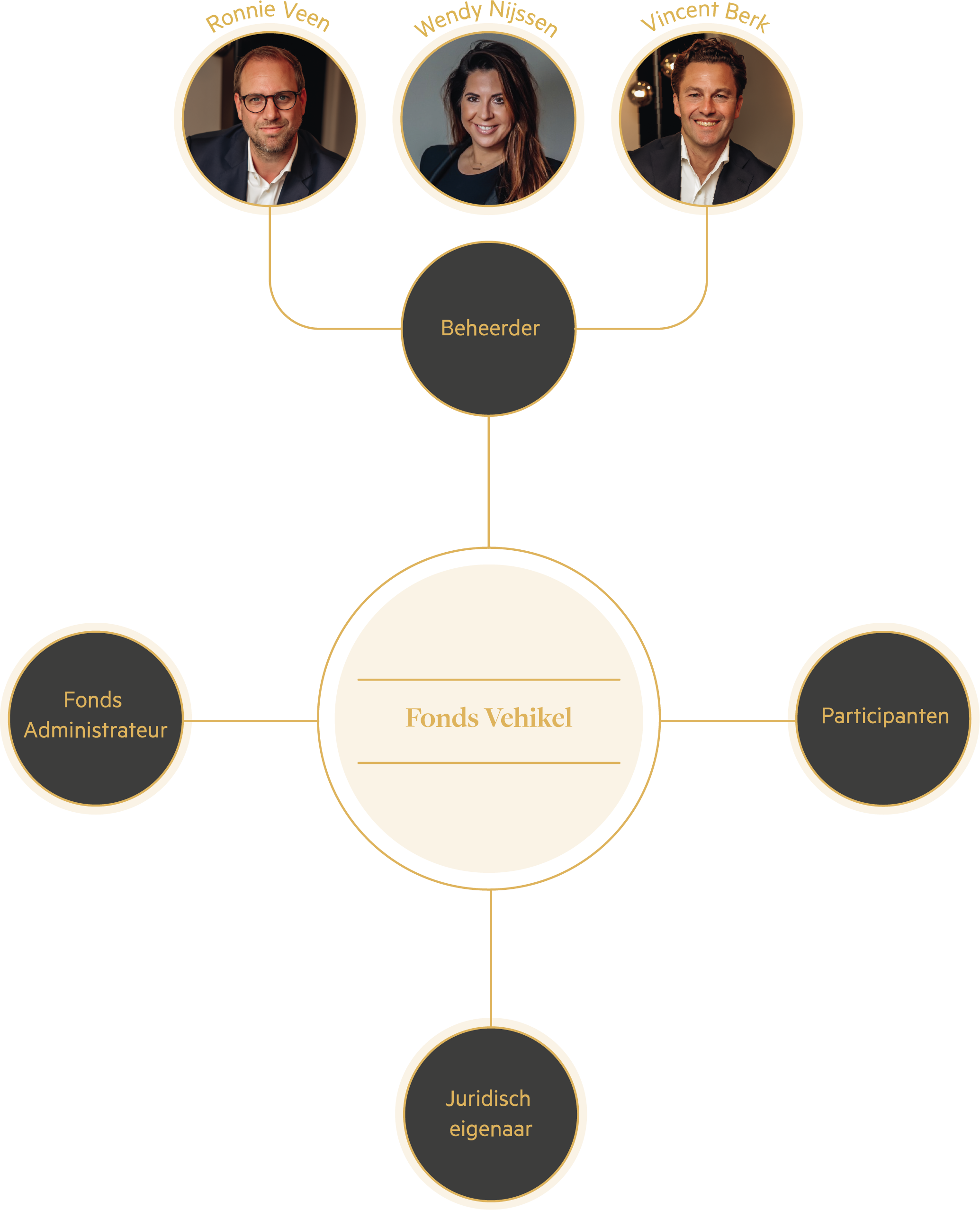

Involved parties

Administrator

Jupiter Capital Management

Legal owner

Jupiter Capital Abu Dhabi Ltd

Fund administrator

Accountant/Advisor

Financial supervision law advisor

Tax law advisor

Jupiter focust op diverse gebieden:

Questions about the Dubai Fund?

Wilt u meer weten, ontvang dan vrijblijvend onze brochure. Schroom daarnaast niet om contact met ons op te nemen indien u vragen heeft.